It was a surreal moment on Thursday night. We were frantically preparing for the start of the Cranky Network Awards when I received a message from one of the two attendees from Canada’s Lynx Air. A work emergency had come up and they wouldn’t be able to make it. That seemed odd at such a late hour, but about five minutes later, I found out the truth. Lynx had given up and would shut down. A “work emergency” was quite the understatement.

This is a mild surprise that Lynx was first to give up, but there was no question that some Canadian airlines would have to fail. There just isn’t enough demand for them all, and more failures are likely to come.

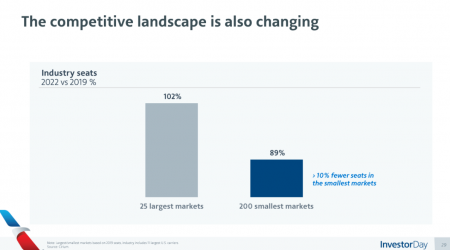

The Canadian market is not big. I mean that from a population perspective, because from a land area perspective, it is absolutely enormous. By land mass, Canada is actually slightly bigger than the US, but in 2021 it had only a little over 38 million people, about a tenth the size of the US.

The population is also highly concentrated. The top six metro areas in Canada — Toronto, Montréal, Vancouver, Ottawa, Calgary, and Edmonton — account for nearly half the population. In fact, there are only 17 metros in the whole country with more than 250,000 people. In the US, the top six metro areas account for only 20 percent of the population.

The Canadian market is also highly seasonal. In the winter, travelers flood south to warm up. Summer is more of an east-west flow. There are only so many airlines that are needed to serve this country.

Since the 1980s, Canada had been a two-airline market. At the end of 1999, number one Air Canada took over number two Canadian, creating a vacuum. WestJet — which had launched operations in 1996 — stepped right in and began expand rapidly to fill the void as the country’s number two.

This relationship held even though WestJet got distracted, straying away from its lower-cost short-haul operation into everything from turboprops on one end to widebodies on the other. In the last few years, the dynamic between the “big 2” in Canada has changed.

WestJet did a reset during the pandemic and, with a big investment from Alberta, refocused its flying in the west, primarily at Calgary and Edmonton. It also took over Sunwing and folded Swoop into mainline, creating a much greater leisure focus in the company.

Air Canada has continued to grow as Canada’s global carrier, but it has backed off in Calgary where there’s just too much capacity from WestJet.

While this was going on, Porter, long a turboprop operator focused on Toronto/City airport, decided it was time to grow. It placed orders for dozens of Embraer E2 aircraft, opening a base at Toronto/Pearson and growing across the country and deeper into the US.

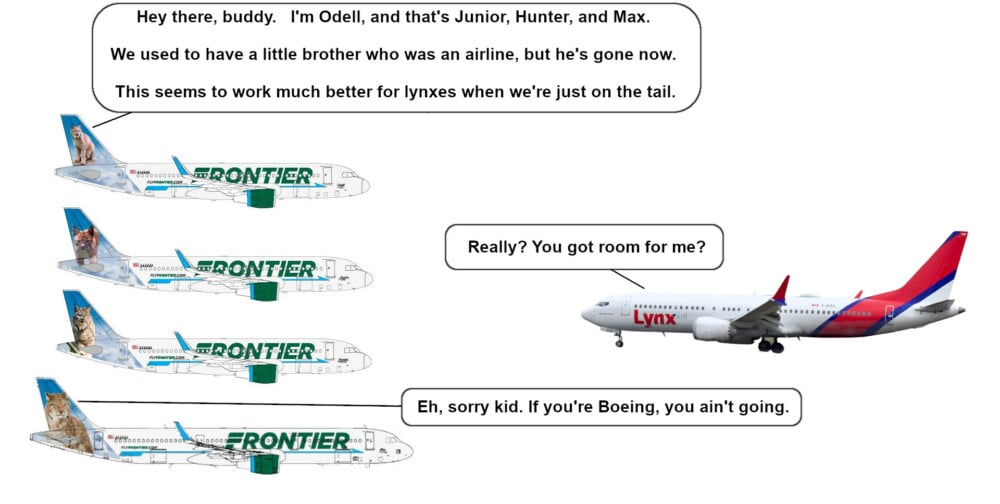

On the lower end, the race was on to create an ultra low-cost carrier that could carry the torch. Three were in the running. First, there was Canada Jetlines, an airline that had grand plans but never made a serious effort. It still flies a little today, mostly from Toronto with Florida and Caribbean flights, but it is an afterthought.

That left Flair and Lynx to fight it out for supremacy. On the surface, you’d have assumed Lynx would be the winner. Lynx was backed by Indigo, Bill Franke’s investment vehicle that has seen success with several airlines around the world. The airline was well-funded and had experienced backing. Flair, on the other hand, was (and is) entangled in a very messy ownership situation with 777 Partners. It has had problems getting the aircraft it needs, and the airline has had to pullback on growth plans.

In recent days, there had been talk of a merger between the two with Flair the surviving entity. That shows just how desperate things must have been at the end to try to salvage anything from Lynx before it died. In the end, no deal was done and Lynx threw in the towel.

In that announcement last Thursday, Lynx said it would keep flying through Sunday to help people get where they were going. Then it would shut down. It looks like there were enough delays that the airline kept flying into the early morning hours on Monday, but when Lynx 130 touched down in Calgary after 2 in the morning, the airline was done.

Why did it shut down? Well, the answer is obvious… it couldn’t make money. But Lynx specifically called out “compounding financial pressures associated with inflation, fuel costs, exchange rates, cost of capital, regulatory costs and competitive tension in the Canadian market.” Yeah, that.

This leaves Flair as the only credible ultra-low cost operator in the country, but it remains to be seen if that’s a sustainable position. Of course, we all know that Air Canada isn’t going anywhere. It will remain the country’s flag carrier and most important airline no matter what. But if Canada truly is a two-airline market, then who will number two be? Will it be Flair, Porter, or WestJet? There isn’t a simple answer here.

Flair may end up being the winner on unit costs, but then again, Canadian airport costs are very expensive so it’s harder to be a real low cost operator. Porter looks the most like a national carrier, but it is taking on a lot of debt to put all those airplanes into service. It’s not an easy burden to bear. And WestJet, well, there’s been so much uncertainty about WestJet that it’s hard to know where that airline ends up after all its route shifting, mergers, and acquisitions.

It is a shame to see Lynx fail, but it is hardly a surprise. Now the question is… who is next?