American Airlines held its first investor day in years yesterday, and while several execs did a good job highlighting many of the changes going on around the airline, it was the commercial strategy that I found to be wild. American didn’t talk at all about its product. Instead Chief Commercial Officer Vasu Raja spoke about the only two things the airline thinks matter on the commercial side: the network and the AAdvantage frequent flier program.

The good news here is that American does now seem to have a coherent systemwide strategy. The bad news is that it either doesn’t understand its own strategy or it’s just playing coy about it. Either way, it’s going to be a lot tougher to make work than American is letting on.

If I had to sum up the strategy based on the presentation, I’d say it is to use the network and AAdvantage to avoid competing and cater to those small city folks who don’t have other better options. If this sounds familiar, it should. When American didn’t know what to do with its remaining LaGuardia slot portfolio right after the US Airways merger, it used this exact plan. Instead of trying to cater to New Yorkers with their plentiful alternatives, US Airways was trying to cater to the people of Charlottesville (VA) or elsewhere who didn’t have other options. This is apparently now American’s strategy systemwide.

We already know that American is most interested in the southern half of the country where it has the biggest presence — primarily on domestic, short-haul flying — and that it will lean heavily on partners for long-haul flying. This has been very clear for quite some time. But what American showed yesterday is that it doesn’t want to focus on big cities in general, at least not outside of its fortress hubs.

Why on earth would American prefer smaller cities? People in those cities are generally held captive by fewer airlines. Less competition and higher fares is the norm, and that has only accelerated as of late. In American’s view, this is being exacerbated by both Delta and United opting to upgauge their fleets to larger aircraft. With larger airplanes, unit costs go down, but of course, the number of people you need to fill an airplane goes up.

With Delta and United going to the bigger end and investing heavily in the customer, American thinks it should go the exact opposite way. It is proud to say that it wants more regional aircraft, focusing on lower trip costs instead of lower unit costs. Though it is retiring its 50-seaters by the end of the decade, it wants more 65-76 seaters in a dual-class configuration that it can use to better serve these smaller markets and get all that high-dollar flying

On the surface, this doesn’t sound like a bad idea. If Delta and United are going to zig, then American may be better off zagging. My two issues here are 1) I don’t think the opportunity is as big as American suggests it is and 2) Business travel is key for this market segment, and American has a self-inflicted disadvantage in competing for that traveler.

American isn’t wrong that smaller cities have suffered since the pandemic with dwindling service, but some of that is due to structural issues that American can’t overcome. For example, pilot costs have gone through the roof, and when you only have 65-76 seats to spread that expense out, unit cost problems creep up quickly. Also, smaller aircraft are just not being made, and 50-seaters are on their way out. (American says its will be gone by the end of the decade.) With that in mind, American needs mid-size markets with high fares to make this work.

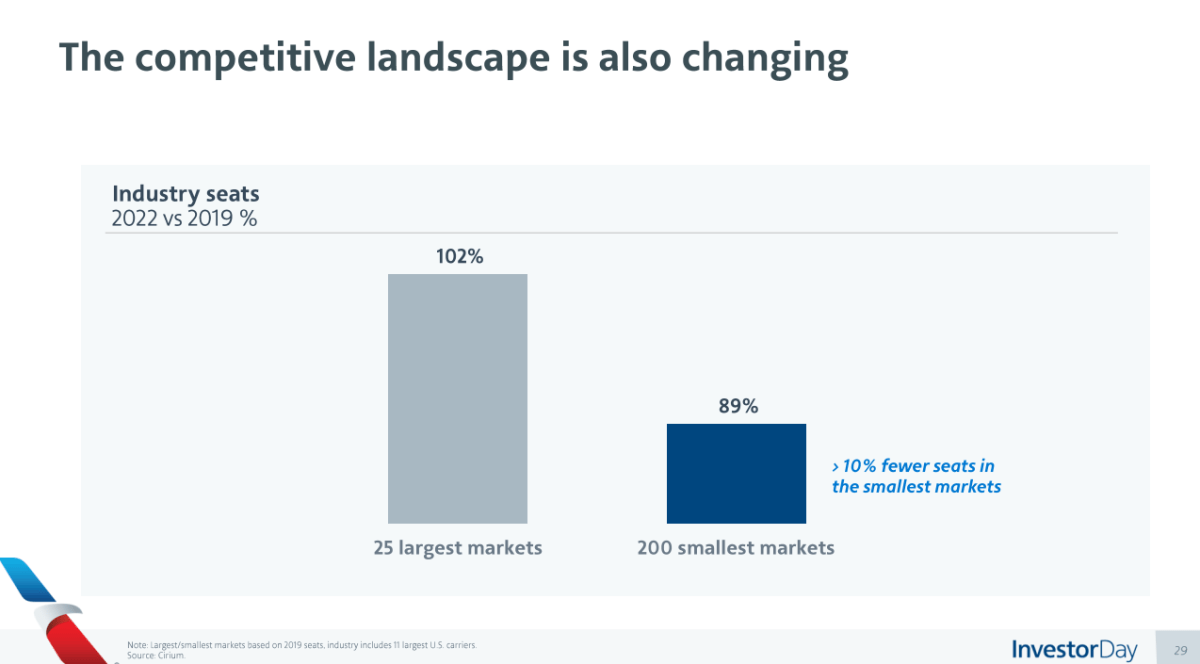

The way American pitches its plan, it’s not clear that the airline understands that to be the case. Just look at this chart it provided with a deceptively-designed Y axis.

slide via American Airlines

slide via American AirlinesThis chart shows that in the top 25 markets, capacity has more than recovered to pre-pandemic levels. But in the smallest 200 markets, it’s not even close. This is where American wants to live. This is a bad idea.

Bad news for American here… it says in the mice type that this is using market data for the top 11 US carriers based on number of seats using Cirium data. Because of that, I can recreate the data myself, and this data doesn’t show what American wants it to show.

No matter what I did, I could not make this work using 2022 vs 2019, so I’m thinking this is a mistake and it was actually 2023 vs 2019. If not, I’m at a loss. I also think that we are looking at Continental US origins only, because if you include international and all those piddly places in Alaska, then it doesn’t make sense.

With all those assumptions, the top 25 markets do come in exactly as American said:

Data via Cirium

Data via CiriumOverserved! These are terrible places to fly! With 200 markets that are underserved at the bottom of the list, why bother with these big places? I can at least tell you why those bottom 200 aren’t a good idea. If we are looking at Continental US origins with service in 2019, there are 312 markets. And, well, just look how this breaks down.

2023 Seats as % of 2019 By Continental US Origin Grouping Data via Cirum, based on Continental US departing seats worldwide for 11 largest US carriers, ranked by 2019 seats

Data via Cirum, based on Continental US departing seats worldwide for 11 largest US carriers, ranked by 2019 seatsUsing the bottom 200 markets, then yes indeed, 2023 is at 89 percent of 2019. But most of these are markets American will never serve and never can. To give you a sense, the largest of the “bottom 200” markets is Tallahassee followed by South Bend and Charlottesville (VA). Those are decent targets. But at the bottom end you have all those essential air service markets and other abandoned little markets that simply are not ever going to be viable. The idea that there are 200 markets with endless opportunity for American at the bottom end is silly and overstates the actual opportunity… mid-size cities.

All those mid-size cities fall into the top-125. And believe it or not, the 100 markets after the top 25 have more service as a percentage of 2019 than those in the top 25. This completely refutes American’s rationale for going smaller. But with the bottom end far too small, it’s that mid-size world where American could potentially live. It’s not because there aren’t enough seats in many of those markets. The opportunity is for a different reason, and that can be explained using El Paso, the market American highlighted in its presentation.

American fawned all over El Paso as being one of those underserved markets where American’s hub structure gives it a unique ability to best serve the population. El Paso, if you’re wondering, falls at number 55 on the top market list, so it is firmly in that second tier of markets in my chart but outside of the bottom 200. El Paso’s 2023 seats are actually at 115 percent of 2019, so this is not a generally-underserved market as American suggests.

This is a market with growing competition. In fact, Frontier just announced two new routes — Ontario and San Diego — from El Paso recently. These are the kind of markets that will get more service as the ultra low cost operators move away from the largest leisure cities to try and find new opportunity. These are also the markets that Southwest will defend to the death.

In El Paso, American says it has a “unique network advantage” because of its hub locations. That is true to some extent. Here’s a look at May 2024 routes by airline.

Data via Cirium

Data via CiriumWith service to LA, Phoenix, Chicago, and DFW, American can take people in all directions. This is certainly a strategically-picked market to show the dominance over Delta which only serves Atlanta. United has Chicago, Denver, and Houston, so it really just lacks something going directly west. But that’s what Southwest is for. Southwest is and remains the most dominant airline in the market by far.

But there is more going on under the surface here. Though coverage is generally good, markets like El Paso have seen an erosion in network connectivity as Delta and United upgauge. They have less frequency and bigger airplanes instead.

2023 vs 2019 El Paso Departures and Seats per Departure Data via Cirum

Data via CirumSouthwest has more than restored 2019 levels and has bigger gauge. The legacy carriers, on the other hand, are well down on departures but with a higher number of seats per departure… by a lot.

This means El Paso isn’t hurting for seats, and it has ample service to mid- and large-size markets on Southwest and others. But there could be a needle to thread that would fly people from El Paso to cities that are too small for Southwest with greater frequency since Delta and United have upgauged and pulled back. This is a real struggle to see how much opportunity really is there, because for American to make this work with those higher unit costs on regional aircraft, it has to keep fares high and still attract a decent number of travelers.

Where frequency and small market connectivity matters is to the business traveler. But as I’ve exhaustively covered here over the last year, American is busy trying to upend business travel and remove agencies and other intermediaries from the process. In other words, American has already tied one hand behind its back as it enters the ring to win the fight. But the other hand is dangling something tempting.

This is where we get into the AAdvantage side of the equation. The mantra for the airline as repeated more than once yesterday is now “Life is better as an AAdvantage customer.” And really what that means is that travelers that they can lock in to be AAdvantage members and ultimately credit cardholders will be stickier and more profitable.

To achieve this, American says it’s providing great value for AAdvantage members, but really what it’s doing is taking away value from non-AAdvantage members. For example, it has now reduced the length of credit validity for those who aren’t members. Also, only AAdvantage members are allowed to stand-by for an earlier flight. You get the point. Joining AAdvantage is free, so American can make even the casual traveler agree to join just to avoid the annoyance.

Once American has people trapped in its web, then it will start to push hard on those credit card signups. That’s where it makes really good money, and it spoke a lot in the presentation about how that part of the business is going to grow.

With AAdvantage members, it can also focus more on the upsell. American says that 55 percent of its customers do not buy the lowest fare and instead pay up for refundability, extra benefits, premium seating, etc. Making up the remaining 45 percent, American says that 25 percent are AAdvantage members while the other 20 percent are not. And then somehow, American makes the jump to saying that those AAdvantage members want to be upsold, but they just haven’t been given the right offer yet. I have absolutely no idea how they get to that point, but ultimately there is apparently magical opportunity that is yet untapped with those people. All American needs to do is get them signed up for AAdvantage.

All of this is pitched as a consumer benefit, and oh, it’s so easy! But it’s not. I think this slide might be my favorite.

What exactly is easy about this? There are six different categories of earning, and three of those are ranges. This is not easy. This is confusing and annoying for travelers to try to navigate. But maybe that’s the point. Once people are locked in to a more complex system, that makes them stickier as well.

My takeaway from all this is that American seems to have a strategy, but it either doesn’t understand it or doesn’t want those outside the company to understand it. What American has pitched sounds like a slam dunk if you listen to the presentation, but the reality underlying the strategy is far more tenuous. It seems clear that American doesn’t think it can compete with Delta and United in a fair fight, so it is going to focus on those places where it can use the network to win in an unfair fight and use AAdvantage to get them locked in if they think about straying.

The size and potential of this opportunity isn’t clear to me. This requires people who need high frequency in smaller markets and are willing to pay good money to overcome the higher unit costs of operating the small regional aircraft.

Beyond size of the opportunity, there’s also the question about what competitive response will occur. If I’m Delta and United and feeling bold, I’m offering huge raises to my regional pilots. I am relying on them less and less, but it’ll reset the market and sink American’s strategy. If I’m Southwest, I’m going to sit on American in mid-size to large- and mid-size markets, making sure that it really can only win in mid-size to small-size or mid-size to long-haul markets that I don’t serve.

This doesn’t seem like the kind of positioning you’d expect from — as American describes itself — a global network carrier. But it is the opposite of what Delta and United have been doing, so it may very well be American’s best shot. It doesn’t seem nearly as promising as the airline would have us all believe, but that doesn’t mean it can’t work.