JetBlue has put out some new updated guidance for Q3 of 2024, and it is looking (relatively) good. In a year when airlines have had nothing but downward revisions, JetBlue says things are looking significantly better than the previous guidance suggested. This is great, but it’s also the easiest part of the process. The hard part will be coming in the not-too-distant future.

As we all know, JetBlue has had some rough years since the pandemic began. In 2019, it was doing quite well. with a full year operating margin of nearly 10 percent. For Q2 2019, the adjusted operating margin was 12 percent. Q2 of this year? It was a meager 2.4 percent. And that’s during the good spring break and summer months.

JetBlue seemed to flail during the pandemic under the leadership of CEO Robin Hayes. He departed this Feb and new CEO (previously President) Joanna Geraghty re-made the management team. Since that time, things have been changing at a torrid pace under her and President Marty St George’s leadership.

The latest investor presentation from the airline gives a progress report of sorts on how it’s all going.

As promised, the airline has slowed growth dramatically. It’s a far cry from the days of the expected merger with Spirit where it was all about growth and synergy and other silliness that was not rooted in reality.

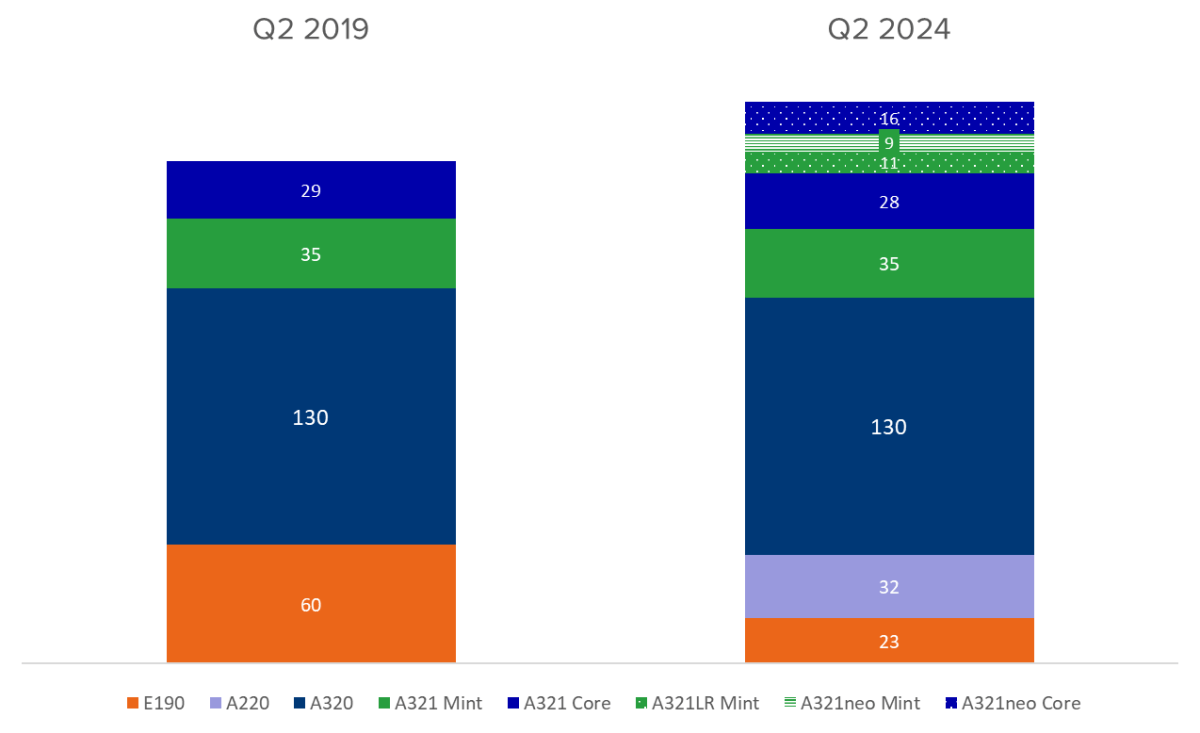

To be clear, the fleet has grown from 254 and the end of Q2 2019 to 284 at the end of Q2 2024, and much complexity has been added. But that topline number is misleading. You can see the breakdown here:

Data via SEC filings and other sources

This looks like adequate growth, but it’s like watching a duck glide peacefully across the water. Down below the surface, that duck is paddling like crazy.

Several of those A321neos are on the ground thanks to the Pratt & Whitney engine issue. There will be 11 on average out of service this year with that spiking to the mid- to high teens next year. But to blame that for JetBlue’s woes doesn’t make much sense when you think about how little capacity JetBlue wants right now. It has also deferred airplanes on order to further reduce commitments and most importantly, capital expenditure.

To offset that to some extent, JetBlue is extending leases on A320s. Why? It’s cheap. It’s a lot cheaper than buying a brand new A321neo. It does also continue to replace the 100-seat Embraer 190s with 140-seat A220s. That process will be done next year.

Then we have to think about the network. Europe has become a thing since 2019. Though further growth there is unlikely, JetBlue is flying longer distances than it did back in the day.

The end result is an airline that has not grown all that much in some ways but has actually grown in others. Longer flights with more seats in Q2 2024 vs Q2 2019? ASMs are up, seats are down, and flights are WAY down.

Data via Cirium

The network is a key piece of this. As I’ve already written, JetBlue has shrunk back down to being primarily a Northeast and Florida carrier. Everything else has been culled.

via JetBlue

With all this work well underway, we get back to JetBlue’s changed Q3 guidance. Revenue was supposed to be down year-over-year between 1.5 and 5.5 percent. Now, it’ll be down no more than 2.5 percent and could even be UP by 1 percent. (Costs are lower as well, but I’m focusing on the revenue side today.) This is welcome news.

In short, JetBlue has been doing all the right things. Much of this is just about fixing the previous regime’s problems. This is good and it shows the new team has its priorities in order, but it’s also low-hanging fruit.

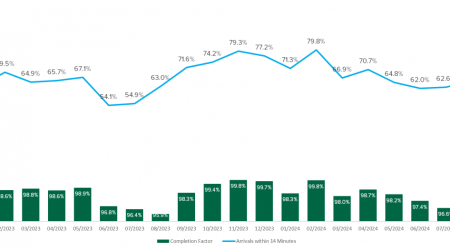

The airline is refocusing on Boston, reconfiguring New York, and rethinking how it will best serve Florida and San Juan. It will shrink down as needed, or at least keep growth numbers low. And it says it will continue to work on running a better operation, something that is at best a work in progress. It may not sound like it, but this is the easy stuff.

Once JetBlue’s previous mistakes have been fixed and the airline is running well, then what? There’s no real opportunity to grow in New York. The airline can keep filling out New England and Florida, but it needs to find future strategic growth opportunity.

I know what many of you are saying… “JetBlue needs a midcontinent hub.” No, it doesn’t. Now if there is a city with opportunity that happens to be in the middle, then great. This can’t be just about looking at a route map and trying to fill in white space. This is about looking at spreadsheets and data to try to find where an opportunity might exist.

This, I should note, is not a job with easy answers. And frankly, those answers may not exist today. If Spirit goes bankrupt? There’s one easy opportunity to backfill. Should American pull down Chicago further? That’s another to consider. (I don’t expect it to happen, however.) There are also things that can be done with fleet to create new opportunities.

JetBlue is working on its reset, and it’s doing it well. But the airline has to become nimble and ready to pounce whenever the right opportunity presents itself. Finding and executing those opportunities? That’s the hard part.