Southwest hasn’t broken under the weight of its activist investor, Elliott, but it has now bent. It appears that the airline is making a calculated move to save itself from being unable to control its own destiny with a human sacrifice. Whether this will work or not is unclear, but it should at least buy the airline time.

Southwest says it is doing a “comprehensive board refreshment,” which, I believe, in Herb Kelleher’s day would mean somebody ran out to the store to get more Wild Turkey and cigarettes. But now it’s a little different. This means a few things, as current Board Chair Gary Kelly detailed in a letter to shareholders.

Here is what’s happening, and it is a pretty big deal.

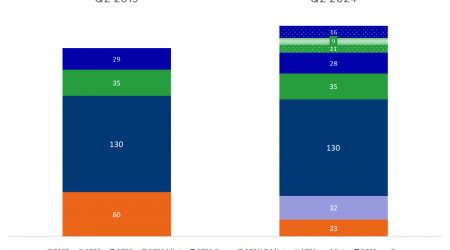

Former CEO and current Board Chair Gary Kelly will retire after the 2025 annual meeting Six of the other 14 board members will retire: David Biegler (Former CEO of Southcross Energy Partners) Veronica Biggins (Managing Partner of Diversified Search LLC) Sen. Roy Blunt Dr. William Cunningham (Former Chancellor of The University of Texas System) Dr. Thomas Gilligan (Director of Hoover Institution at Stanford University) Jill Soltau (Former CEO of J.C. Penney) Four new board members will be added, three of which will be given “due consideration” from Elliott’s list of nominees The Executive Committee structure will be eliminated and a new Finance Committee will be formedThe general idea here is pretty clear. Elliott wanted Gary’s head, and they got it. Elliott also wanted ten new board members out of the fifteen seats, or two-thirds. It now may get up to three out of a smaller twelve-person board, or one-quarter. Elliott also wanted CEO Bob Jordan’s head, but the board has said it is strongly backing him in his current role.

In other words, this is not everything Elliott wanted, but Southwest hopes it might be enough. Elliott, however, made that clear in a statement it issued regarding the moves that it most certainly is not.

We learned yesterday, which was made public today, that nearly half of Southwest’s Board of Directors had decided to resign based on shareholder feedback. In our experience, this is unprecedented.

We are pleased that the Board is beginning to recognize the degree of change that will be required at Southwest, and we hope to engage with the remaining directors to align on the further necessary changes.

The need for thoughtful, deliberate change at Southwest remains urgent, and we believe the highly qualified nominees we have put forward are the right people to steady the Board and chart a new course for the airline.

Like I said, this makes it pretty clear. Elliott likes these changes, but it’s not going to just accept them and call it a day. These guys have never really seemed interested in operating through compromise. They are going to keep pushing and pushing and pushing. Just ask the government of Argentina.

Of course, from Southwest’s perspective, that may not matter. If I’m Southwest, I know Elliott won’t compromise, but I also know that Elliott only owns about 10 percent of the company. For Elliott’s plans to work, it has to convince other investors to go along with its plans, and that isn’t going to be so easy.

My guess is that Southwest was hearing from some investors that they weren’t happy and may have been considering supporting some of what Elliott wanted. So Southwest made some pretty sweeping changes on the board level to try to appease those investors. These are investors that probably don’t have much love for Elliott anyway, but they like the general sentiment. They want their investment to be worth more than it is.

With the changes Southwest is making now, it can probably help pull investors off the fence and more into the airline’s camp. It makes it harder for Elliott to get the votes it needs… at least right now.

Of course, this is not a permanent thing. Southwest needs to start churning out better results. The pressure is on, and it is time to perform. Southwest CEO Bob Jordan and COO Andrew Watterson certainly know this. Their clock starts in a couple weeks when Southwest has its investor day where it says it’ll release an updated business plan.

If the airline can start to see real improvement and the stock price soars, Elliott will presumably cash out and walk away. But if not, Elliott will continue to pressure for improvement until it finds enough investors to agree. If nothing else, this move by Southwest at least buys the airline some more time.

If you aren’t already subscribing to The Air Show, you’re missing out on some great episodes the last few weeks. Two weeks ago, it was a mailbag episode. Then we tackled Airbus last week. And this week, we dove into the new DOT focus on frequent flier programs.

Listen on Spotify, Apple Podcasts, Amazon, Pocket Casts