We’re going into the long holiday weekend, so I thought I’d give you something other than turkey to chew on until I’m back posting on Monday.

The idea of a post-COVID recovery sounds quaint these days. Most markets are back or beyond where they were in 2019, but not every market. The biggest laggard is China, though it’s not a laggard everywhere. China hasn’t struggled to get flying again domestically at all. Sure, the growth rate has slowed dramatically from the heady days of yore, but we are still flirting with record highs. It’s the flying outside of Asia that has been so problematic for China. A mix of weaker demand, Russian flying restrictions, and geopolitical turbulence have made the Chinese market a tough one.

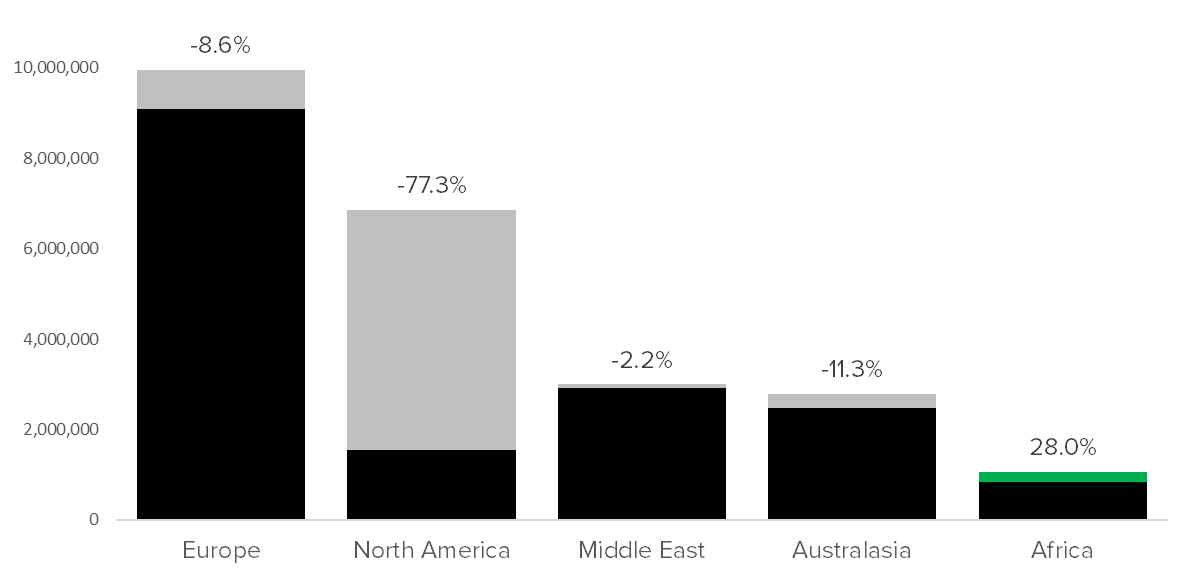

It’s not often that I find myself comparing numbers to 2019 anymore, but for China, it’s essential. Here’s how the market looks outside of Asia.

FY 2024 vs 2019 Seat Change from China

Data via Cirium

The only market that’s up is Africa. It’s up a lot, but it’s off a very small base. The biggest increase comes from Egyptair with some new flying from China Eastern and Hainan. But let’s not dwell on this, because it’s not that significant.

The Middle East is the market that has held up the best after Africa, down only 2.2 percent. The Chinese carriers have grown in this market, but the Gulf carriers are all way down. That is somewhat of a surprise, but it shows that if there is strength, it comes from within China, not from the outside.

After that, the story becomes more dire. In Australasia, Jetstar has pulled out and Qantas mainline is down 75 percent. But Air China and China Southern are down a lot as well. It’s the secondary carriers in China that are keeping that market above water, airlines like Sichuan and Xiamen, with some China Eastern growth in the mix too.

And that brings us to the big two markets. At least, these markets used to be the big two. North America is down an incredible amount with less than a quarter of traffic returning post-pandemic. This is about the US, but it’s also about Canada. Every airline is down… a lot.

Of course, the biggest driver of this is geopolitical. There are artificial restrictions in place that keep flying between the US and China low. But it’s about more than that. Take Canada, a country which just had its China market open back up fully when restrictions were recently lifted. July 2024 seats were more than 90 percent below July 2019, but July 2025 as of now is scheduled to rise more than 200 percent. That is a lot of additional flying… but Canada will still be down more than 70 percent vs prior to the pandemic.

While that may mean progress, it seems likely that it’ll be a long time before 2019 levels are restored. And in the US, even if the shackles were thrown off, it would also take a long time to get even close.

Take a look at these side-by-side charts below. On the right side are the Chinese airlines. On the left are the other carriers, mostly US-based.

Marketing Carrier US-China Seats by Airline

Data via Cirium

That amount of growth that Chinese airlines poured into the market starting in the 2016 timeframe is insane and not supportable. But there was a lot of subsidy money flying around in China back then, and every airline decided to take a swing at the US.

These five airline groups from China are still in the US market in some way or another, but they are all down significantly, none more than Hainan which was always the wildest of the bunch. And on the US side, Hawaiian is out, so is any intra-Asia flying which still existed, and American is barely in the market now that it’s abandoned it LA Transpacific hub.

Delta and United are the two main players, but even they are down significantly. The only thing keeping the US-China market alive at all is Shanghai because of business connections. Otherwise things would look even worse. Take a gander at what I mean in the chart below.

Seat Share by China Origin City to US

Data via Cirium

Leading up to the pandemic in July 2019, Beijing had north of 40 percent of all seats departing China for the US while Shanghai was just over 35 percent. In July 2024, however, Beijing is just above 30 percent while Shanghai is almost at 45 percent. It’s a notable swing.

And this brings us to Europe, where the signs are even more concerning. Why? Because unlike in the US, Europe did come roaring back, but now it is reversing itself.

Europe is down only a little under 9 percent, but the airlines are dropping like flies. Before the pandemic, there was as many as 16 carriers flying between Europe and China. There were 13 flying from May 2023 through this October. But now, it’s down to nine as several carriers realize there’s no money to be made. On top of that, some existing airlines are ending or suspending some of the routes they were flying.

Here’s a list:

Virgin Atlantic exited China (via Shanghai) in October British Airways ended Beijing in October but still flies Shanghai Neos exited China (via Nanjing) in October SAS exited China (via Shanghai) in November LOT is suspending service to China (via Beijing) for the winter, but it plans to come back for summer Lufthansa is suspending Frankfurt – Beijing for the winter, but it still flies there from Munich and plans to come back for summer in FrankfurtThe real question for Europe is what will actually come back next summer, and it’s too early to know for sure. But as of now, July 2025 is showing 3.5 percent fewer seats than July 2024.

How long all of this continues remains to be seen, but with a new US administration that seems poised to be very hawkish with China, things aren’t likely going to get better any time soon.