Frontier CEO Barry Biffle took the stage at Morgan Stanley’s 12th Annual Laguna Conference last week, and it was all unicorns and rainbows. Barry says that Frontier has been turned around, and while there are some things that still need to be done, the airline is well on its way to besting pre-pandemic performance.

This may or may not be true, but there are reasons to believe that some of these positive signs may not be sustained. The good news is that over time we will learn the answer. But for now, let’s talk about what he had to say.

Overall, Barry says everything is going in the right direction. On the revenue side, July was down, August was flat, but September is up. And the trend going forward will continue. In fact, things are so great that Frontier is now expecting Q3’s pre-tax margin to be somewhere between -2 percent and flat. Previously it was expecting it to be somewhere between -6 and -3 percent.

According to the airline’s 8-K, the “majority” of that improvement comes from revenue coming in higher than expected. Why? Capacity is moderating. As is pretty much universally agreed upon in the industry, there is too much capacity and many airlines are taking steps to rein that in, including Frontier.

The problem for Frontier is actually figuring out why its revenue is doing what it’s doing. The airline has made sweeping changes over the past year, and when you do that, it means you can’t tag one specific change as being the reason for revenues doing better.

Even beyond the revenue initiatives, Barry didn’t hesitate to find yet another reason why revenue was improving. He says an improved operation has something to do with better performance. But, uh, the operation is still a complete mess.

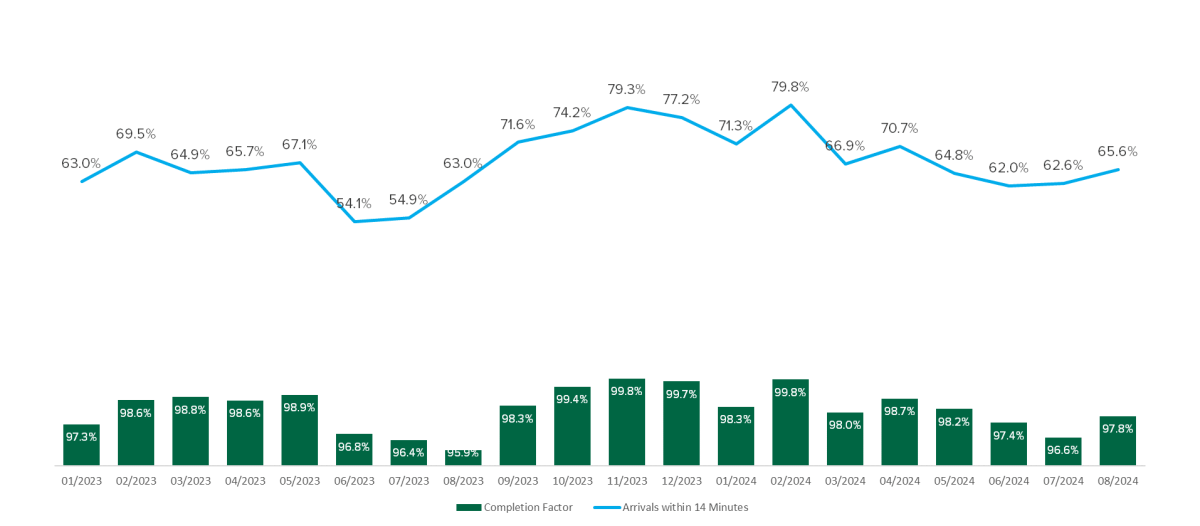

Frontier Operational Performance by Month

Data via Anuvu

I suppose compared to last summer, this year does look better. But looking “better” is not the same as looking “good.” And Frontier is nowhere near looking good at this point when it’s running fewer than 65 percent of flights on time and canceling more than 2 percent through the summer.

Whatever the reason for the revenue bump, Frontier knows it has made so many changes that it thinks it needs to shift its success metrics. It used to pay close attention to ancillary revenue, but now it doesn’t care. Its goal is to make $125 each way per customer, and it doesn’t worry if that’s in the fare or ancillaries.

For comparison purposes, in the first half of the year, Frontier made $42.68 in fare and $70.15 in ancillary for a total of $112.83. It still needs unit revenues to grow more than 10 percent to get in the range it wants to be in.

Barry did make an interesting comment on this point. Common sense suggests that if the fare is lower, people will spend more on ancillary services. But in reality he says it has always been that a lower fare means people pay less for ancillaries. So they need to get a higher fare.

That’s the point of the entire effort to remake the airline’s fare products. It now has the various bundles that can be priced during the initial search, including the UpFront Plus product which includes a blocked middle seat. That, Barry says, already has 70 percent paid load factor. But the airline is reducing each set of three seats’ revenue-generating capability by a third when it blocks them, so whether the fare those seats are getting is worth it remains unknown to us.

On the cost side, Barry took a pointed dig at United CEO Scott Kirby and Chief Commercial Officer Andrew Nocella who have been touting “cost convergence” between low-cost and full-service operators as one reason that the low-cost operators will go out of business. But Barry says the airline keeps driving down costs and the gap is actually widening. I suppose we’ll see how that’s going when Q3 numbers come out.

Going forward, Barry says the airline will grow in the single digits for a bit, but it’ll be back in double digits in the next couple years. He also said he will be “shocked” if Frontier isn’t making double digit margins by Q2 of next year. That’s how confident this man is.

So will it happen?

We certainly don’t know. We only have data through Q2 now, and the numbers have apparently started looking better during Q3… according to Barry.

The guidance update is encouraging, no doubt, but this is also a tale of two quarters. The first half of Q3 is in peak summer while the second half is in the doldrums as a general rule. But even if we knew Q3, there’s a whole lot more to see before anyone can declare victory.

Q1 of this year was an absolute bloodbath with load factors and revenue taking a big hit. I want to see a real change in Q1 for Frontier before I even start feeling optimistic.

There’s no question that Barry’s job is part executive and part cheerleader. He has made so many changes in the last year, that his success or failure is directly tied to how these initiatives pan out. If he weren’t shouting with joy from the rooftops, I’d be very concerned.

I’m just not willing to declare victory at this point. This is going to be a longer road.