As the big ultra low cost carriers (ULCCs) continue to bleed money, many have asked questions about how things went so wrong so quickly. The thing is, it didn’t happen all that fast. The ULCCs, specifically Frontier and Spirit, were heading in this direction for some time. It’s just after COVID settled that the problems came into focus. There are a lot of things that have gone wrong, and today I want to put some numbers to it, using Cirium data. Specifically, I’m looking at Frontier today, but much of this applies to Spirit as well.

Let’s take a trip back to 2014. Frontier had been bought by Indigo Partners at the end of 2013, and the airline had sped up its already-started move to a ULCC model. Our story will start in the first quarter of 2014 when some change had been made, but there was much left to do.

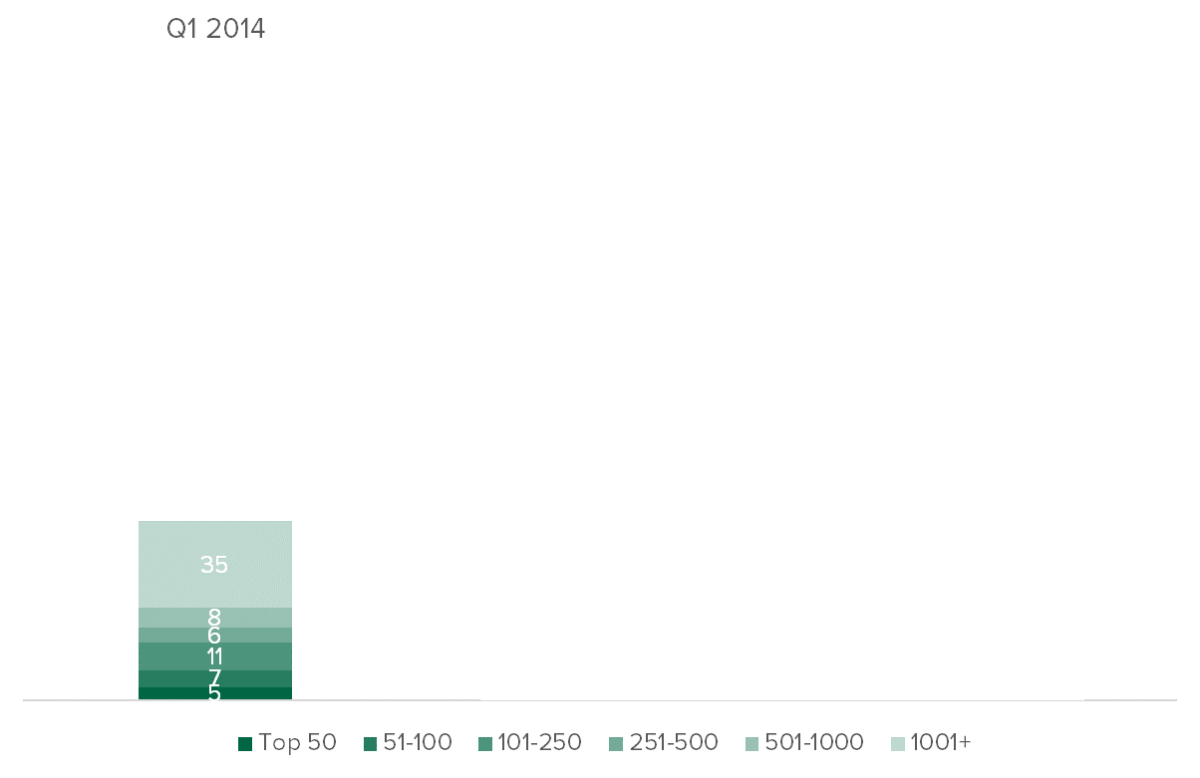

Below you will see how the airline’s routes broke down based on total route size for all carriers (based on DB1B, so it’s domestic-only).

Frontier Domestic Routes by Local Market Size

Data via Cirium, market size based on DB1B PDEW

The airline at that time had only about 7 percent of flights in the top 50 markets in the US. On the other hand, nearly 50 percent were in the markets ranked 1,000 or smaller. Some of those were actually small markets, and they relied on connectivity through the Denver hub. Others were new secondary airports like Trenton which had no historical demand to speak of before Frontier arrived.

Frontier’s previous strategy was as a higher-frequency hub-and-spoke carrier. This is the airline that flew A318s and A319s with seatback TVs. The airline was moving to a ULCC strategy, and that meant it needed to drive its unit costs down dramatically. Those aircraft were not the right ones for that, and Frontier had to go bigger. That fundamentally changed the markets that would work for the airline.

If we fast forward five years to Q1 2019, you’ll find a completely different airline.

Frontier Domestic Routes by Local Market Size

Data via Cirium, market size based on DB1B PDEW

This airline looks to be massively larger than the one five years earlier. It had grown, but not nearly as much as you’d think. The airline had departures increase only about 56 percent, but it was using bigger airplanes. Seats doubled. Still, the biggest reason for the way this looks is Frontier went to a much lower frequency.

In Q1 2014, Frontier ran 2.96 departures per route per day. By Q1 2019, that number had plunged to 1.32 departures per day. Bigger airplanes and fewer flights on more routes with less competition. This was the plan, and it appeared to be working.

Frontier had reduced the percent of markets ranked 1,000 or smaller from half to a third, but the big growth was in the 251 to 1,000 range. The big markets, those ranked from 1 to 250, had actually dropped from 32 percent of routes to only 24 percent.

The airline had really shied away from big airports. Sure, there was a lot of demand there, but there was also a ton of competition. That’s not only from the legacy carriers and Southwest but also from Spirit which had gotten to bigger markets well before Frontier adopted the ULCC model.

Now, if we fast forward another five years to Q1 2024, however, the story has changed again.

Frontier Domestic Routes by Local Market Size

Data via Cirium, market size based on DB1B PDEW

Those markets ranked 1,000 and smaller now account for a puny 13.5 percent. Meanwhile, 101-500 ranked markets are up to about half of the routes the airline flies. Top 100 markets have climbed from 12.3 percent of all routes in 2019 to 18.1 percent in 2024.

The airline has shifted into bigger markets, the ones it avoided for years. But why? Well, it’s pretty obvious, but I’ll let this chart do the talking.

Frontier Average Seats per Departure by Year

Data via Cirium

Frontier has done nothing but grow, grow, grow its fleet. For the first time as scheduled in 2024, Frontier has topped 200 seats on average per departure. It’s been a never-ending increase as the airline has shed smaller airplanes. First it got rid of the Embraer 190s that were operating when Republic owned the airline. Then the A318s disappeared and the A319s followed.

Today, it’s only A320s and A321s, both ceo and neo versions, that fly for Frontier. And the A321neo carries a remarkable 240 people, or at least it did before Frontier started trying to go upmarket and block middle seats in the first couple rows. Now it’s at 236, I suppose.

This is an incredible number of seats. How can Frontier fill them? Well it sure can’t do it in tiny markets, so it needed to go bigger. But those big markets are the very same ones that the legacies and Southwest dominate. They don’t like Frontier going big, but they have learned that they can use bigger airplanes and profitably price match the ULCCs with a Basic Economy fare. As total capacity rises and the legacies can snag more of Frontier’s business, it just makes it even harder for Frontier to fill its airplanes with a workable fare. How tough?

Frontier Load Factor by Market Rank by Quarter

Data via Cirium, market size based on DB1B PDEW

The smaller markets were already well below the bigger ones, but now those fell off a cliff in Q1 of this year. With such big airplanes, those small markets just don’t work. So, Frontier continues to go for bigger ones. Just look at last week’s announcement of 11 new routes:

Atlanta – Austin, Newark, Washington/Dulles Burbank – Denver, Phoenix, San Francisco Cincinnati – Sarasota New York/JFK – Orlando, Tampa Salt Lake City – Seattle Washington/Dulles – OrlandoSome of these markets are huge, like JFK to Orlando, while others are smaller unless you consider the broader metro. For example, Burbank to Denver may not be big, but if you think about Frontier’s opportunity to steal passengers that fly out of LAX or Ontario, the market becomes much bigger. That’s the kind of thing that Frontier hopes will help it get back to profit.

This won’t be easy, because as we know, fares have fallen in the domestic market especially thanks to too much capacity. The end result is a mess of red ink.

But Frontier isn’t relying solely on trying to find better routes to solve its problems. It’s now trying to boost its fare in a tough environment. It doesn’t think it can get big enough volumes with the fares it’s been getting, so it’s trying these bundled products including blocked middle seats, bags, etc that make it easier for people to spend more money with the airline. Spirit is doing the same thing.

A higher fare with the same number of passengers is better, but there’s still not enough of a market to support all those big airplanes that were scheduled to come in. That’s why both Spirit and Frontier have deferred aircraft orders. They are just trying to figure out how to make money with the airplanes they have today.

None of this paints a particularly rosy picture for the ULCCs. If I’m at the legacy airlines, I smell blood and will try to sit on top of these airlines until they disappear. If Spirit or Frontier were to fail — and Spirit is currently in worse financial shape — then that would boost the other airline’s prospects for survival. But the current environment doesn’t seem like it’ll be sustainable unless there’s a dramatic turn in demand. Even then, it’ll be temporary. It always is.