The announcements seem to be coming fast and furious. Coming out of the pandemic, people have shown a rapidly-increasing willigness to pay up for more comfort and a better experience on airplanes. This is nothing new in the world of long-haul flying, but on shorter hauls, it is quickly creating the “haves” and the “have-nots.” Now it’s the latter group that is trying to play catch-up.

This is the first part of a two-part series to look at this trend in greater detail. Today, Iʻll look at the long-haul fleet. Get ready for the more dynamic short-haul opportunity soon.

We’ve seen this shift to premium on the long-haul fleet over a lengthy period of time. Think about the introduction of premium economy, the densifying of regular coach, the growth in extra legroom seats, and the arms race on improving and expanding business class options. (“Mine has a door!” “In mine, you’ll never have to see another person!” “Mine has the letter Q in it!”)

Historically, we’ve seen airlines fall all over the map with their premium strategies. Back in the 1980s, airlines like PEOPLExpress jammed in 446 coach seats into their 747s and had a mere 24 in First Class. Pan Am, on the other hand, put only 347 coach seats onboard alongside 21 First Class and 44 Clipper (Business) Class. (At least, those were configurations at one point; I’m sure it changed multiple times.)

Over time, First Class was nearly pushed out of existence, being replaced by an ever-growing Business Class cabin. These Business cabins introduced flat beds in the last twenty years, growing their physical footprint and taking over more of the cabin real estate. Then Premium Economy came to replace Business Class. It was just a shifting of naming conventions, but the one trend was that these premium cabins kept growing.

The advent of the ability to charge for seat assignments created a new opportunity with extra legroom in coach. I’ll talk more about that tomorrow in the short-haul discussion, but once airlines could charge for more legroom in the same cabin, it gave them a whole new outlook on exit rows and beyond.

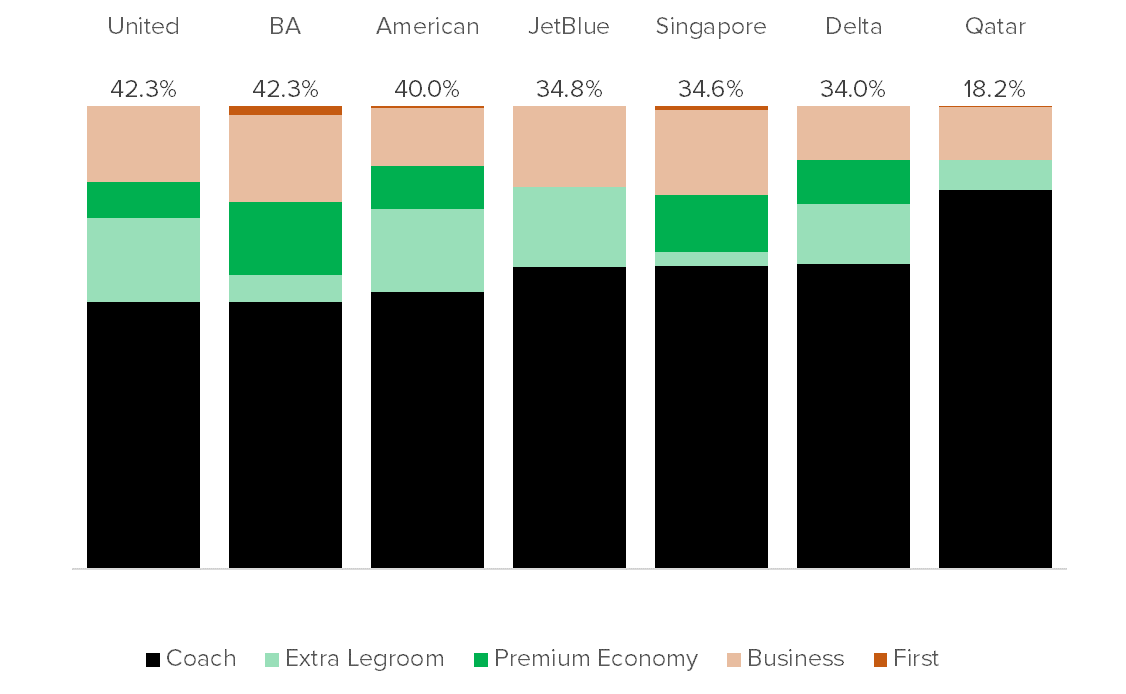

What does this look like today? Well, here’s my best effort to look at how seating breaks down on the long-haul fleet by airline.

% of Long-Haul Fleet With Upsell Opportunity

For US carriers, I used fleet numbers from their most recent 10-Ks. For the others I just looked at more recent sources. In some cases, I had to assume a single configuration when not all aircraft had been converted to a new one yet, but this shows the basic lay of the land.

It’s not a surprise to see British Airways at the front of this list. London is generally one of the most premium markets in the world, and the seat count reflects that. More than 42 percent of seats on the airline’s long-haul airplanes can be considered an upsell opportunity from basic coach seating.

What might be more surprising is that United is just about the same as BA, but that is a bit misleading. The difference here is that United has a very large Economy Plus extra legroom section while BA has just exit rows. BA has much larger true premium cabins (1/3 of its fleet), which better reflects the London market while United is just around 1/4 of the seats if we leave out Economy Plus.

That being said, United recognizes the importance of premium in London as well. After all, it puts its lightly-loaded Boeing 767-300ER on most London flights. That airplane has a mere 1/3 of its seats in the coach cabin and more than 40 percent in Business and Premium Economy.

Those are two airlines that are doing quite well with their international networks in the current climate, and it’s a model to be emulated if your airline is in the right market. You may be a little surprised to see that American isn’t far behind. With American, however, it is again a huge Main Cabin Extra legroom section that takes up the bulk of that. Without Main Cabin Extra, American has about 22 percent of seats in premium economy or higher. If we look at the fleet, however, its 787s have been lower, 18 percent on the 787-9s. That would explain why new deliveries will have a bigger cabin up front. They undersized premium on those airplanes.

Perhaps the biggest surprise in this entire thing is that Delta has such a low percentage of premium on its long-haul fleet. This is an airline that’s been doing very well, so how is that possible? Well, first, there is a legacy problem here. The 767s have just 30 percent of seats outside regular coach while the A330-330s have 28 percent. We do have to remember that some of those 767s are flown domestically, so those have a different level of demand as well.

But when we look at Delta’s new deliveries, it has 40 percent outside coach on its A330-900neos, and the A350 original configuration is 38 percent. Its newest A350 config, however, has over 42 percent. So Delta is in the right ballpark here as it renews its fleet. Considering Delta saw coach revenues relatively flat last quarter while premium cabin surged, it probably wishes it could add premium more quickly.

JetBlue has a similar split to Delta on its A321LRs that fly across the Pond. The thing is, that’s a pretty small sample that’s barely worth including. But JetBlue does have a very big business class cabin as a percent of total seats. Then again, with only 138 total seats on that airplane, the numbers are going to skew very easily.

If you don’t watch the Middle East carriers closely, you might be surprised to see Qatar with such a low percent of non-coach seats. Qatar doesn’t have a premium economy cabin, nor does it have extra legroom outside of exit rows/bulkheads, but that’s by design. It’s important to remember that Qatar and all of the Middle East carriers carry a lot of workers in and out of the country to and from their homelands. These are not high-paying jobs, but they do need to travel back and forth. Those big coach cabins are important due to the mix of passengers in that region.

Meanwhile, the people who are willing to pay for premium will pay up for business class. At least, that’s Qatar’s belief. Emirates did just roll out its first premium economy cabin, so maybe things are changing.

The takeaway here is that every region is different, but some premium component is key to success. This is not a new trend. Remember when Ryanair CEO Michael O’Leary said that if they flew across the Pond they’d need to offer “beds and blowjobs”? The difference now is really more in the middle. Premium economy is hugely profitable and extra legroom seats take very little additional revenue to justify their worth.

As long as airlines can continue to upsell passengers, they will keep adding more options above the base level to capture that revenue. Those who have those premium opportunities will continue to do well for now, but who knows when those winds will change direction.

Soon, I’ll talk about the more complex situation in the short-haul market.