There is much to be written on what has happened to the ultra low-cost carriers in a post-pandemic world. We will probably see some not-so-great results when Frontier and Spirit report Q2 numbers soon. While we all know that United CEO Scott Kirby has said their days are numbered, it is far more nuanced than that. We are working on an episode of The Air Show which will go deeper into this, but today, I just want to focus on one issue: route overlap.

We’ve heard the legacy carriers crow about just how good they are at competing with the ULCCs, and they aren’t wrong. They do seem to have figured out how to make life difficult for the ULCCs where they overlap. The biggest problem for Frontier and Spirit is that they overlap a ton, but strangely enough, they’re starting to overlap more. Let’s try to untangle this.

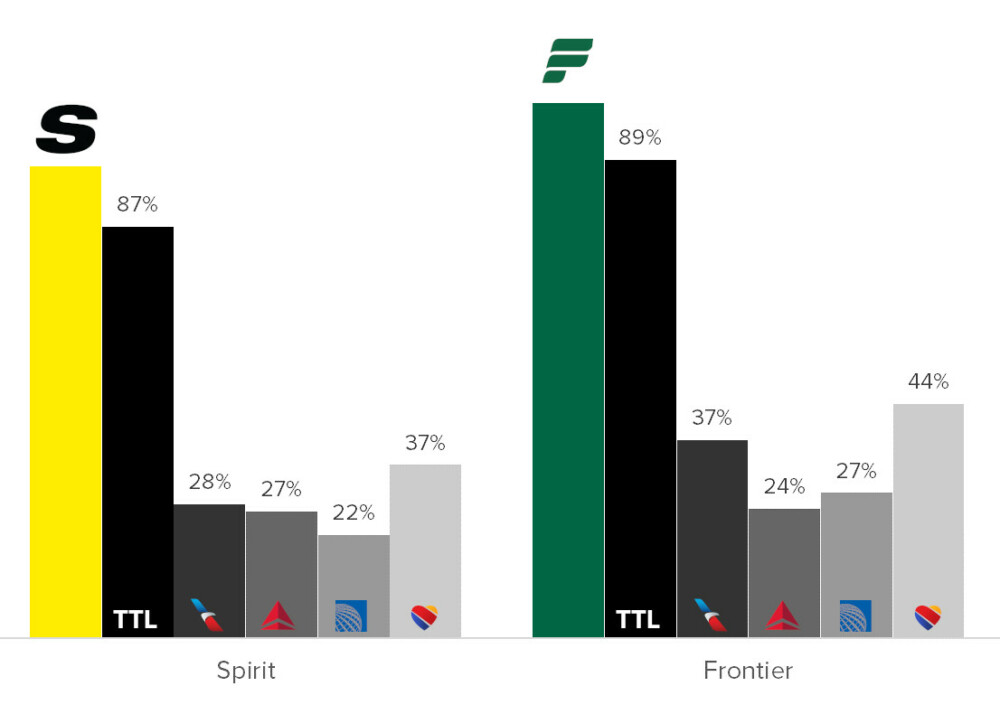

I took a look at July 2024 schedules in Cirium data to show just how much things vary by airline in terms of overlap. Let’s start with Spirit and Frontier. Note that the overlap is airport-specific here, so this is the most conservative possible number. If you include metro areas, overlap would increase.

Route Overlap Percentage for Spirit and Frontier – July 2024

Data via Cirium

The relative scale here shows that Frontier actually has more routes than Spirit, but that isn’t a surprise. After all, Spirit has historically done a lot more flying on specific routes every day while Frontier has long done sub-daily flying as its primary schedule pattern.

It’s pretty interesting to see that both have total overlap that’s very similar, in the high 80 percent range. I also broke this down versus the big four US carriers since that’s where the overlap is most problematic.

Southwest has the most overlap for both of these carriers, and it is no tiny number. Frontier has more overlap than Spirit with every airline except Delta. That stands to reason since Frontier’s bases in Philly and Denver create a lot of overlap with the other three airlines. But regardless of how you look at this, the overlap is more than 20% for every single airline.

This is a lot. Or it’s a little. There isn’t really context here, so let me give you some. Take a look at Allegiant.

Route Overlap Percentage for Allegiant – July 2024

Data via Cirium

Allegiant has more routes than Frontier or Spirit, but it has such little overlap. Only 14 percent of its routes have any overlap while none of the big four has more than 6 percent. That is one reason why Allegiant has been performing significantly better. It owns its markets, and it has built a remarkably defensive position that is highly unlikely to be touched by the big four. Any competitive pressure that hits Frontier and Spirit does not hit Allegiant.

This is more like what we see in Europe. For example, here’s Ryanair which is far bigger than all of these US ULCCs put together.

Route Overlap Percentage for Ryanair – July 2024

Data via Cirium

Ryanair is one of the biggest airlines in the world, and it only has overlap on about a third of its routes. Most of that overlap isn’t coming from the big guys. I even included SAS in the Air France-KLM numbers and ITA in the Lufthansa Group numbers. The result is the same. Those airlines have focused on their hubs with limited point-to-point flying on the likes of Eurowings, Transavia, and Vueling while Ryanair has taken over the rest of the continent (along with Wizz).

Yes, some of this is because Ryanair serves more secondary airports, but that’s a mistake to think that explains everything. Ryanair just owns markets.

Why can’t ULCCs do this in the US? I’ll point to Southwest. The big three legacies did indeed rally around their hubs, but all that connective tissue between mid-size cities was owned by Southwest before the term ULCC existed. It’s proving to be hard for airlines to compete with Southwest for that traffic in the US just from a “total capacity” perspective. Since this old school LCC type of airline doesn’t exist in Europe, it’s like shooting fish in a barrel for Ryanair.

This does make the US market harder than the European one if you’re a ULCC, because there just aren’t places to go where service is truly lacking, at least not in large quantities. So airlines just have to decide with whom they want to overlap most. And Frontier has decided it wants to shift course in that regard.

Frontier has remade its network over the last year after posting horrendous results in Orlando and Las Vegas where capacity grew too much for them to be successful. So what did Frontier’s year-over-year change look like?

Route Overlap Percentage for Frontier – July 2024 vs July 2023

Data via Cirium

Frontier actually has more routes this year, but you’ll notice that its overlap hasn’t changed much. It was 90 percent last year, and this year it’s 89 percent. It’s just that where the overlap lies has changed.

Frontier’s overlap with Southwest has dropped from 51 percent to 44 percent while the overlap with the big three has increased. American has the most with the rise from 27 to 37 percent. This all makes sense.

Southwest is big in places like Las Vegas from which Frontier has chosen to redirect capacity. If you look, Southwest and Frontier overlap on a similar number of markets year-over-year. It’s just that all of Frontier’s growth has gone elsewhere, to markets like Philly and DFW and Charlotte where American is big. It has put capacity in Delta and United markets too, but just not as much.

Does this mean Southwest is really that good and Frontier is running away? More likely it just means that Southwest has added more capacity and is playing the long game of sacrificing now to protect its markets. The legacies have not done this to the same extent, so Frontier sees this as a rosier target.

Naturally, nothing is as easy as having no or limited competition, but that really isn’t an option in the US in any meaningful way. So Frontier and Spirit keep searching for where they can be most relevant and profitable. Right now, it would appear Frontier sees more opportunity against the legacies. This is pretty amusing since those are the same legacies who say that they are killing ULCCs off. Q2 financial results should tell us more about which narrative is closer to being correct.