More than 60 taxing entities across Utah are considering property tax hikes and, if approved, 19 proposed increases would affect Salt Lake County residents.

To find which entities want to hike taxes in your area, input your address into the graphic below and click on your location to scroll through all the governments and agencies that apply to your property and find what increases they are proposing.

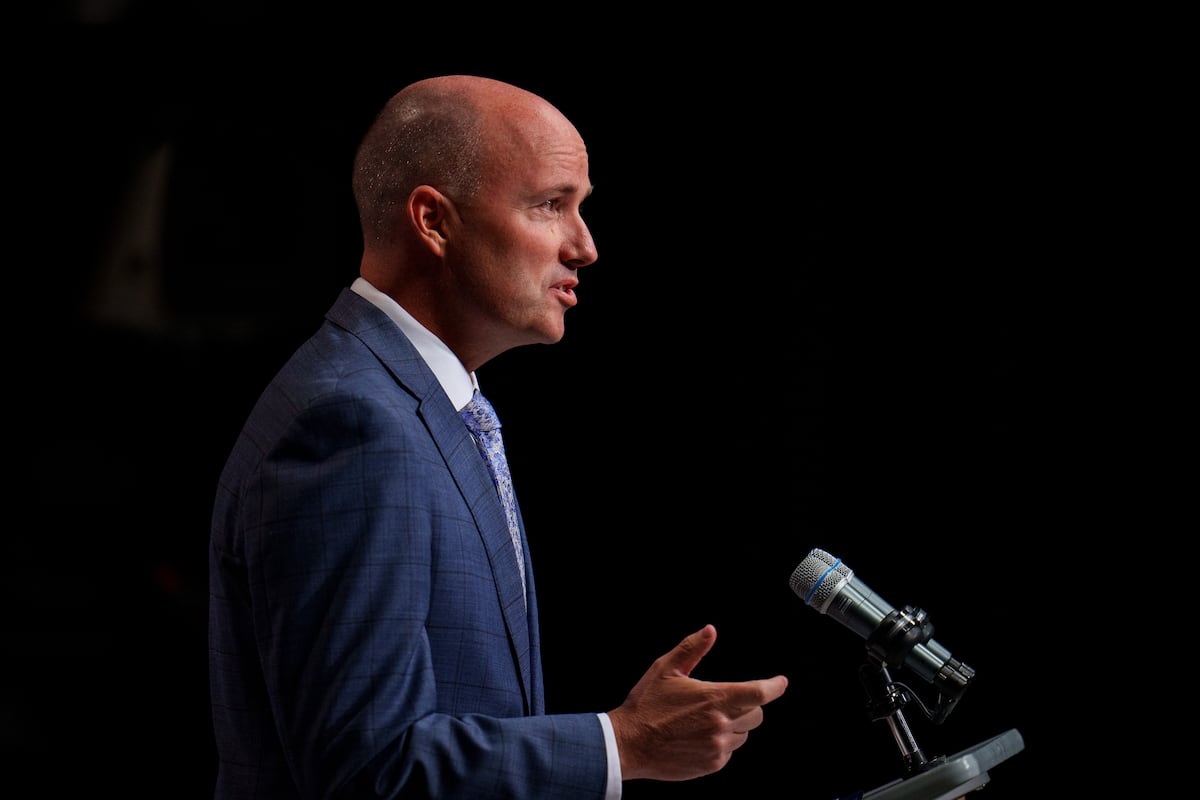

As taxes rise, Wasatch Front property values are also going up, said Salt Lake County Assessor Chris Stavros. Residential values are up by a median of about 6%, he said, and commercial values are up by a median of about 4.8%.

“This is becoming a higher and higher-priced market over time,” Stavros said, noting that the county’s median value for residential properties is $602,000.

Under state law, when property values go up, tax rates must fall accordingly to produce the same amount of revenue for the taxing entities that they received the year before. The county can’t just raise property values, Stavros explained, to produce a windfall for an area’s tax entities.

If a taxing entity wants to generate more revenue than what it collected in previous years, it must hold what is called a “truth in taxation” hearing, where the public can weigh in on proposed increases.

“People always ask, ‘Well, if the laws are in place that prevent the entities from receiving more than they did the prior year, then how did my taxes go up?’” Stavros said. “Typically, it’s because there were taxing entities that went through the public hearing process, and the public meeting process requesting tax increases.”

Valuation notices went out in Salt Lake County in mid-July, so Stavros advises taxpayers to now take two steps.

First, residents should determine if they believe their value estimation is accurate in accordance with market values as of Jan. 1, 2023. If taxpayers want to contest their valuation, they have a 45-day period from Aug. 1 to Sept. 15 to file an appeal.

If the valuation appears accurate and their taxes sharply increase, residents may go through their tax notices to determine which entities are holding truth-in-taxation hearings.

“People always say, ‘Well, what good does it do to go to the public meeting?’” Stavros said. “Well, I can tell you, it can make a difference. I know last year, Sandy City requested a substantial tax increase, and there was enough people that attended the public meeting, voiced their concerns, and the amount of the tax increase was reduced substantially because of that.”

Tax notices will go out in October after rates are finalized.

Payments are due Dec. 2.

For a list of proposed tax increases, check out the table below. It’s searchable by county and taxing entity, and sortable by county and the dollar amount of the average hike.