Although the central bank cut interest rates aggressively it was not enough as debt service costs rose

Although the South African Reserve Bank cut the repo rate by 300 basis points to 3.5 per cent between December 2019 and July 2020, this failed to cushion the South African consumer as the debt service to household income ratio rose to 9.4 per cent in the second quarter from 9.3 per cent in the first quarter.

This failure had two main components.

Firstly, commercial banks did not pass on the full cut in interest rates to the consumer, so the average overdraft rate only fell by 213 basis points between December and July. Secondly, the national lockdown from 27 March disrupted economic activity so severely that 2.2 million people or 13.6 per cent of the labour force lost their jobs during the second quarter.

Even among the people who did not lose their jobs there were several who got severely cut wages as business went into survival mode and cut costs were possible. The net effect of these two influences was that the household debt to disposable income ratio jumped in the second quarter to 85.3 per cent, the highest since the first quarter 2009, from 73.7 per cent in the first quarter.

To put the South African job losses into context, the US economy suffered a 7.9 per cent decline in employment between March and June. If the percentage job loss had been the same as South Africa, then 21.2 million Americans would have lost their jobs instead of the actual 12.2 million.

Auditing company PwC warned that the loss of jobs and income could result in increased social unrest as more than half the youth did not have a job.

“If unsuccessful in addressing unemployment issues, PwC’s ADAPT framework warns that societies may face increasing social unrest. This rising social and political unrest is already manifesting in South Africa. Following strict movement controls in April and May, protest and other related action increased across the country as lockdown regulations eased.

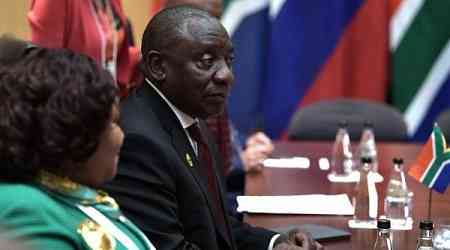

Data from the Armed Conflict Location & Event Data Project (ACLED) shows that the country experienced 180 protest events during September 1-28. This will result in September having the most protest events during a calendar month since the appointment of President Cyril Ramaphosa early in 2018,” PwC said.

The Nedbank Economics team said household finances are expected to remain depressed in the short term even though economic activity is expected to gradually recovery into the third quarter as the country moves to looser lockdown.

“However, general conditions remain extremely weak and confidence remains fragile. Private sector is hesitant to increase investment spending due to weak demand, slow structural reforms, unreliable power supply and weak exports growth among other factors. Some firms have already announced that they will start to restructure operations by cutting operating costs and re-evaluating capital projects. This will inevitably result in retrenchment of workers and exert stress on household finances. Consequently, households are likely to be more cautious of adding more debt despite low interest rates,” Nedbank said.

As household consumption expenditure accounted for 61.7 per cent of the economy in the second quarter, this does not bode well for a swift recovery.

Economists will be hoping that when Finance Minister Tito Mboweni delivers the Medium Term Budget Policy Statement on 21 October he will be able to put South Africa on a sustainable economic growth path.

Helmo Preuss in Langebaan, South Africa for The BRICS Post