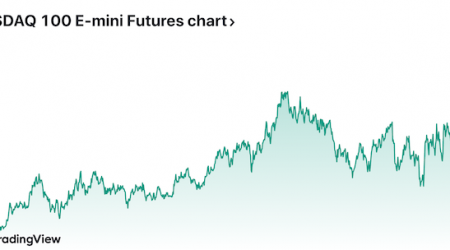

The stock market has been wild for the last few months. Many experts are predicting this volatility is likely to continue , at least for the foreseeable future. There are many factors influencing this volatility too, including global supply chain shortages, changing restrictions on the economy, and uncertainty in many sectors.

Despite some of the turbulent moves and unprecedented events over the last 18 months, the stock market has been pretty kind to most investors, with most major indices enjoying steady bull runs.

What does the rest of 2021 have in store though?

Correction?

There aren’t too many similarities between financial markets and physics, but one solid comparison can be drawn between gravity and the cyclical nature of the stock market.

Take a roller coaster as an example, after leaving the station the train will be pulled up a hill with a chain. Once at the top, it has nowhere to go but down, with gravity converting the stored potential energy into kinetic energy, causing it to gain speed as it plummets towards the ground.

The stock market, as with roller coasters, always has a steep plunge after a long climb to the top.

However, the main difference between the two is that it is easy to predict when the roller coaster will stop climbing since the track is fixed. For the stock market, it is possible to predict “what” but almost impossible to accurately state “when”.

Take a look at just about any major index right now and you’ll see that, apart from a slight dip in early 2020, the roller coaster has been on the lift hill for quite some time now. It will eventually run out of chain lift and will begin to return to earth, but will it happen in the final few months of 2021? It’s nearly impossible to say either way.

Strong Sectors

Regardless of what’s happening in the market as a whole, some sectors are always stronger than others. Over the last year, everything tech-related has performed much better than the market as a whole, partly because of its resilience to declines in consumer spending.

One particularly stand-out area has been gaming. Many of the biggest gaming companies on the planet have enjoyed strong increases in revenue, bumper profits, and rising stock prices that reflect that. EA is trading around 60% up on where it was two years ago while Activision Blizzard has nearly doubled its share price over the same period.

iGaming, the industry that offers online casino games and other forms of betting, has also followed a similar trend. Growth in the United States is a big factor behind that as more states are beginning to permit wagering within their borders. However, the UK market is also looking healthy as more players choose to play online.

To cater to these players, brands are beginning to offer different versions of their games so that there is something for everyone. In roulette, this means that players can choose between American or European rules which have different numbers on the wheels, or opt for a multi-player or live dealer variant. The same goes for many other traditional casino games such as blackjack and slots that are now available online.

Delivery services like Deliveroo and UberEats have also enjoyed strong demand over the last 18 months, though their long-term success depends on whether consumers shift their habits again as economic conditions change again.

Interest Rates

Most analysts will tell you that one of the causes of the long bull run in the stock markets has been that low-interest rates have allowed people to borrow money cheaply and invest it into the stock market.

Low interest rates also mean that people are not incentivized to save, since inflation will eat away their wealth if it’s kept in a bank account.

Many of the biggest names on Wall Street, including Michael Burry, are predicting that interest rates could rise much quicker than central banks are forecasting. Burry, in particular, is predicting a rate rise before the end of 2021 , though again, making predictions about timings is always a difficult game.

If rates do go up, many investors could reduce their holdings in stocks, either to earn interest from banks or to cover the increased cost of borrowing. Either way, most analysts believe this could drive share prices down.