With a dynamic mix of well-established IT giants and up-and-coming entrepreneurs, Nasdaq takes center stage in the big theater of the world's financial markets. Since its founding in 1971, Nasdaq has changed the face of the market by breaking established conventions and being a pioneer in computerized trading.

Similar to a never-sleeping city, Nasdaq is constantly active. In this virtual world, traders from all over the world come together to participate in the activity as data runs through it like a river.

Don't Miss the Boat: The Basics of Nasdaq Futures

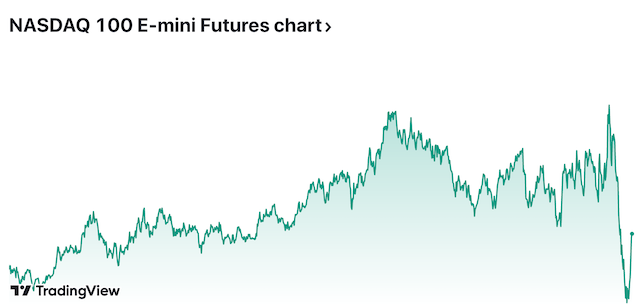

Before you dive deep, understanding the basics of Nasdaq futures is paramount. In essence, a futures contract is a legal agreement to buy or sell a particular commodity or asset at a predetermined price at a specified time in the future.

Why Nasdaq Futures?

Unlike direct stock investments, trading futures allows investors to benefit from both rising and falling markets. This is because, in futures, one can go 'long' (anticipating price rise) or 'short' (anticipating price drop). To make informed decisions, many traders keep an eye on nasdaq futures live data, which offers real-time insights into market movements. The flexibility to adapt to market waves is what makes futures a favorite for many. However, every rose has its thorn. While the potential for gains is heightened, so is the risk. It's essential to understand this double-edged sword before embarking on the Nasdaq futures voyage.

Casting a Wider Net: Understanding Live Data

Live data offers a holistic view of the market, allowing traders to gauge overall sentiment, understand liquidity, and make informed decisions. It's like having a bird's eye view of a dense forest, spotting patterns and pathways otherwise hidden at ground level.

However, not all data points hold equal weight. The art lies in discerning valuable insights from the noise. Successful traders often develop an intuitive sense for data, picking up on subtle shifts and trends that might go unnoticed by the untrained eye.

Diving in Head First: Strategies for Nasdaq Futures Live Trading

A winning strategy often combines both technical and fundamental analysis. While technicals rely on charts, patterns, and past data, fundamentals consider broader economic factors and company specifics. A marriage of these approaches can offer a more rounded perspective.

Tactical Maneuvers

Every market has its rhythm, and Nasdaq is no different. Sometimes, it's a calm waltz, and at other times, a frenetic tango. Recognizing these rhythms and adjusting strategies accordingly is the hallmark of an astute trader.

Safe and Sound

In the turbulent waters of futures trading, risk management is the lifeboat. It's essential to have stop-loss mechanisms, diversify, and never risk more than one can afford to lose.

Tools of the Trade: Essential Platforms and Technologies

A trader's toolset in the modern digital era is full with cutting-edge technology that make navigation easier and more accurate. There are several tools available, ranging from AI-driven predictive analytics to charting software. Additionally, trade may be optimized by diversifying tools based on certain demands, just as one wouldn't use a hammer for every activity.

The Tech Edge

Thanks to developments in AI and machine learning, systems are now able to evaluate large volumes of data quickly, providing predicted insights and even automating some trading processes. It may change everything to embrace this technological revolution.

Staying Ahead: Continuous Learning and Adaptation

It is insufficient to only know your trade or possess expertise in a certain field in the fast-paced world of today. The ability to consistently learn and adjust to novel situations, locations, and difficulties is what really sets one apart. This is especially true for professionals who are navigating the ever-changing Nasdaq and other international markets. The following are important things to remember:

Every Cloud Has a Silver Lining: Learning from Losses and Setbacks

- Reflection: After a failure, stand back and assess what went wrong. Recognize your errors and make sure they don't happen again.

- Resilience: Realize that every setback offers a chance to improve. Accept the knowledge and proceed with fresh vigor.

- Redirection: A defeat might occasionally be a sign that it's time to change course or reevaluate the existing strategy. Remain receptive to novel tactics.

Keeping Your Ear to the Ground: Staying Updated with Market Trends and Shifts

- Regular Research: To keep informed, set aside time on a regular basis to read reports, analyses, and professional viewpoints.

- Networking: Participate in forums, go to conferences, and establish connections with colleagues. Speaking with experts in the subject can yield priceless information.

- Technological Tools: To stay ahead of the curve, make use of contemporary tools and platforms that provide real-time data and predictive analytics.

Riding the Wave: Adapting and Evolving with the Ever-changing Nasdaq Environment

- Flexibility: Be prepared to adjust tactics or approaches in light of fresh insights or evolving situations.

- Continuous Education: Make an investment in training programs, workshops, and certifications that will expand your knowledge and repertoire in the field.

- Feedback Loop: Make a conscious effort to get input from your group as well as other sources. It facilitates the effective recalibrating of your strategy.

The Ball is in Your Court

Nasdaq futures live trading is a science and an art. It takes expertise, gut feeling, fortitude, and the appropriate equipment. Above all, though, it necessitates a love for the game and the willpower to keep playing. Now that you have this knowledge at your disposal, the initiative is yours. You make the move.

Easy Branches Global Guest Posting Services in multi languages

Best last minute News headlines from Your Country and inborn language

Yachts News | Discover the Exclusive World of Yachts

Yachts Listings for Sale and Charter

immediate for delivery New Exclusive Hyper, Mega, Classic and Super sports Cars

Crypto Coins for FREE when use this link