There is no LUV for Southwest Airlines management this week as activist investor Elliott has taken more than a 10 percent stake in the airline and wants to fire Chairman Gary Kelly and CEO Bob Jordan. If you thought Carl Icahn’s investment in JetBlue was going to be a big fight, you ain’t seen nothing yet. This is going to get ugly. So far, I am not impressed by Elliott’s take, but if this does push Southwest to act more quickly, then everyone wins.

At JetBlue, Carl Icahn saw opportunity to boost a lagging stock price, but there was a new management team already trying to shake things up. Icahn wanted more oversight at the airline, but he didn’t publicly demand immediate and specific change other than getting a couple board seats. The situation with Elliott and Southwest is very different.

Elliott has put out a presentation on its Stronger Southwest website saying that the airline is stuck in the mud, and it needs management and strategy to change right away. This is war on the existing management team. Specifically, here is the plan:

The presentation focuses on Board Chair Gary Kelly and CEO Bob Jordan as being the two main targets. Elliott says this:

Current Executive Chairman and CEO are rigidly committed to the status quo. Southwestmust bring in new leadership from outside of the Company for Southwest’s strategy to evolve

If this were happening at American — and frankly, I’m surprised it’s not but then again, Southwest’s balance sheet is a lot more attractive — this might sound sensible. But this is Southwest, and it’s a first red flag that Elliott doesn’t really appreciate the uniqueness of the airline, or ANY airline for that matter.

Southwest’s years of success and stability — which Elliott does recognize — are largely thanks to a culture focused on growing leadership from within. That is good, but it does also breed a slowness in being willing to adapt and change. It’s a double-edged sword. But bringing in a true outsider to come and change the airline swiftly and mercilessly? That is a recipe for disaster at a company like this. You need something in between.

Yes, Southwest has underperformed — you can see all the details in that presentation if you want. Yes, Southwest is slow to change. Elliott should have focused on ways to fix those issues but without throwing the baby out with the bathwater. In other words, Elliott is coming in way too hot, and it seems like its plan will just create more chaos and possibly destroy value if they really push on this plan.

I don’t disagree with much of what Elliott is saying on a high level. The airline needs to be quicker to adapt and like some other airlines, it could benefit from a more proactive, more independent board. If I were Elliott, I’d have focused on the board level, trying to oust Chairman Gary Kelly and picking up at couple of board seats of my own. But trying to chop off the head of the airline’s day-to-day leadership ranks is a far riskier move that is likely to backfire.

That’s not to say that it shouldn’t try to help reform leadership. As Elliott rightly notes, there is not a lot of outside experience at Southwest. COO Andrew Watterson is the lone exception:

The airline could absolutely benefit from more diversity in background at that level. Maybe it is time for some of the longest-tenured folks to move on. But I also think that it would be beneficial for Elliott to try to work with the current CEO to make changes before resorting to regime-toppling. This could be the kick in the pants the airline needs to actually start speeding up real change.

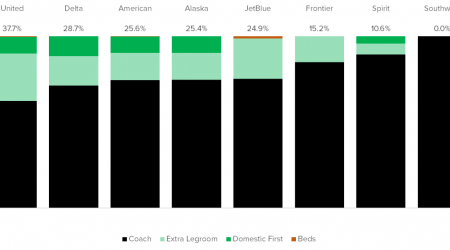

What I find interesting is that last quarter during earnings, we heard Bob talk more about big possible changes to seating and premium products. We were promised more at investor day in September, something real and substantive. I can understand the concern about Southwest not being prone to action, but you’d think Elliott might want to wait for that day before calling for the CEO’s head. I want to hear what the plan is, and maybe this will force it to move up sooner.

The more I read the presentation, the less I think Elliott really knows what it’s looking at here. I just find a lot of the suggestions and conclusions to be poor on the revenue improvement front and only slightly better on the cost containment side. There seems to be some fundamental misunderstandings of why things are the way they are. But don’t take that as a full-throated endorsement of management either.

With Elliott trying to remove Bob and bring in outsiders, the airline should rally around its leadership. Labor is fat and happy with new contracts, so they aren’t likely to play games the way they might have a couple years ago. But leadership needs to give the employees something to rally around, a real plan for improvement.

If there’s one thing a company like Southwest is good at, it’s rallying around its people. And its people are good at rallying around it. My guess is that Elliott has overplayed its hand here. That being said, maybe it can effect change to the board structure and call that a win.

In the end, it only really cares about making money on its investment. This is not how I would have gone about trying to make that happen, but it’s apparently how Elliott likes to operate.