I wrote yesterday about how United had some real struggles filling seats in its Pacific network around the holiday season. But the only comprehensive data I have is load factor information combined with broad unit revenue trends by region as the airline reported in quarterly earnings. Load factor matters, but it’s just one piece of the puzzle.

I highlighted the Pacific yesterday because that’s where the numbers were worst. The airline had a big drop in unit revenue and low load factors. As I said then, that doesn’t mean it’s bad. United, like Delta, can afford to think strategically and invest in markets that might take time to develop. If it tries and everything works right off the bat, then it probably isn’t trying hard enough.

With that in mind, I thought today I’d head over to the Atlantic to look at performance in that market. It was a different story indeed.

Over the Atlantic, United reported having unit revenues grow 11 percent vs last year. Available seat miles grew 4.1 percent if we exclude Tel Aviv since that market could not operate this year due to war. (Including Tel Aviv in last year’s numbers, ASMs were down 6.7 percent year-over-year.) Loads did pretty well too.

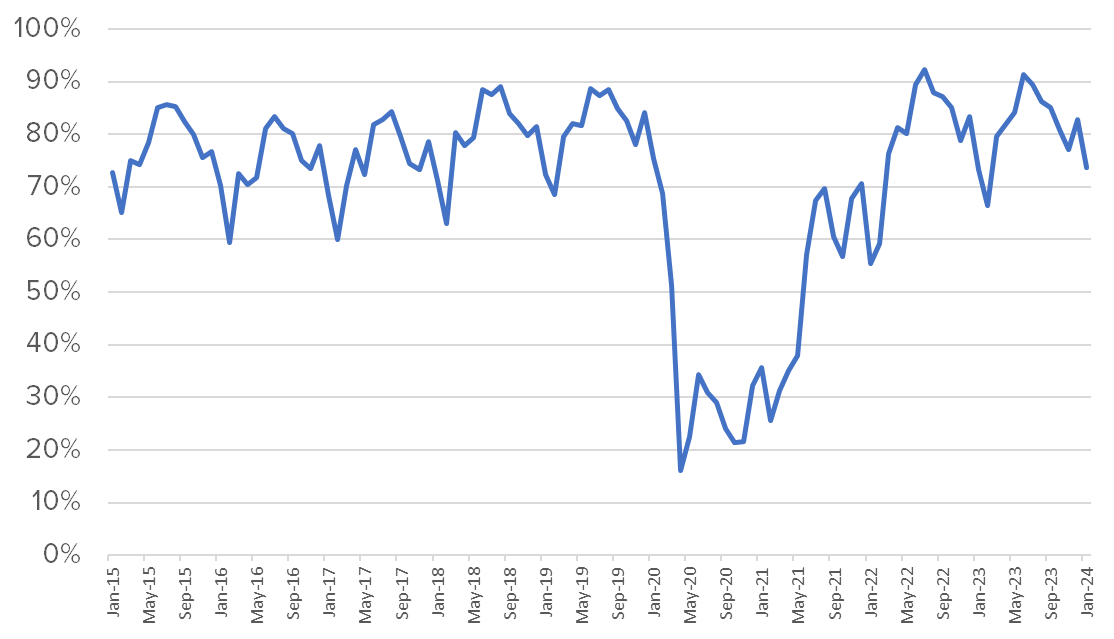

United Europe/Middle East/Africa Load Factor by Month

Data via Cirium

Winter is generally a problem for the Atlantic. You can fill airplanes all summer long with no trouble, but in winter it gets a lot tougher. Instead, airlines tend to rely more on those premium cabin travelers to pay the bills while coach seats go more empty than usual.

As you can see above, this past December and January was pretty similar to the previous year in terms of load factor. Fares must have been just that much better. We’ll see how February holds up, when United hit a low point last year at 66 percent loads.

That’s not to say that every market did well. Take a look.

United Europe/Middle East/Africa Load Factor by Market for Dec 2023/Jan 2024

Data via Cirium

Look at Amman really filling those airplanes. I don’t know fare details, but that appears to have turned out to be a good add. At the bottom end, Amsterdam looks like a real problem child.

United Amsterdam Seats by Month

Data via Cirium

In this case, it looks like United probably just put too much capacity into the market. Dulles didn’t operate in the winter of 2022/2023, but it was back in 2023/2024. In Dec and Jan, seats on United in Amsterdam were up 42.3 percent year-over-year. And compared to 2019, they were still up 21.8 percent.

All the US gateways performed poorly in terms of loads. I’d imagine next winter we’ll see that one pulled back further.

London, on the other hand, is different. Sure, it had the second lowest loads, but Heathrow slots are highly coveted, and United isn’t going to give those up to reduce capacity. London remains a hugely important business market, so the name of the game is frequency and high fares.

All of United’s Newark and Chicago flights and half of Dulles’s during Dec/Jan were on the premium-heavy 767-300ER with only 167 seats. Only LAX supersized capacity with a 318-seat 787-10. The results show that LAX had too many seats, but also, O’Hare probably had too many flights.

United London/Heathrow Dec 2023/Jan 2024 Seats and Loads

Data via Cirium

A market like London is always going to march to the beat of its own drum. They can move cities around and hope for a better outcome. (Remember the brief and bad attempt at Boston – London?) But in the end, the number of flights will stay about the same.

Perhaps more surprising is a market like Lisbon which only filled three-quarters of its seats in Dec/Jan. Lisbon was apparently expected to be a rock star, because United put the 787-10 on the route instead of the smaller 767-400ER from last year. It was just too much airplane, at least for this year.

Here’s the thing about all this. If we look at United’s Atlantic portfolio, there is a whole lot to like. So maybe Amsterdam shouldn’t have had as much flying as it did. And perhaps Lisbon needs a smaller airplane. But those are the kind of things that you can fix easily going forward. If United hadn’t pushed very hard, it probably wouldn’t have found success in some of these other Atlantic markets. Next year, we’ll see what changes the airline makes.