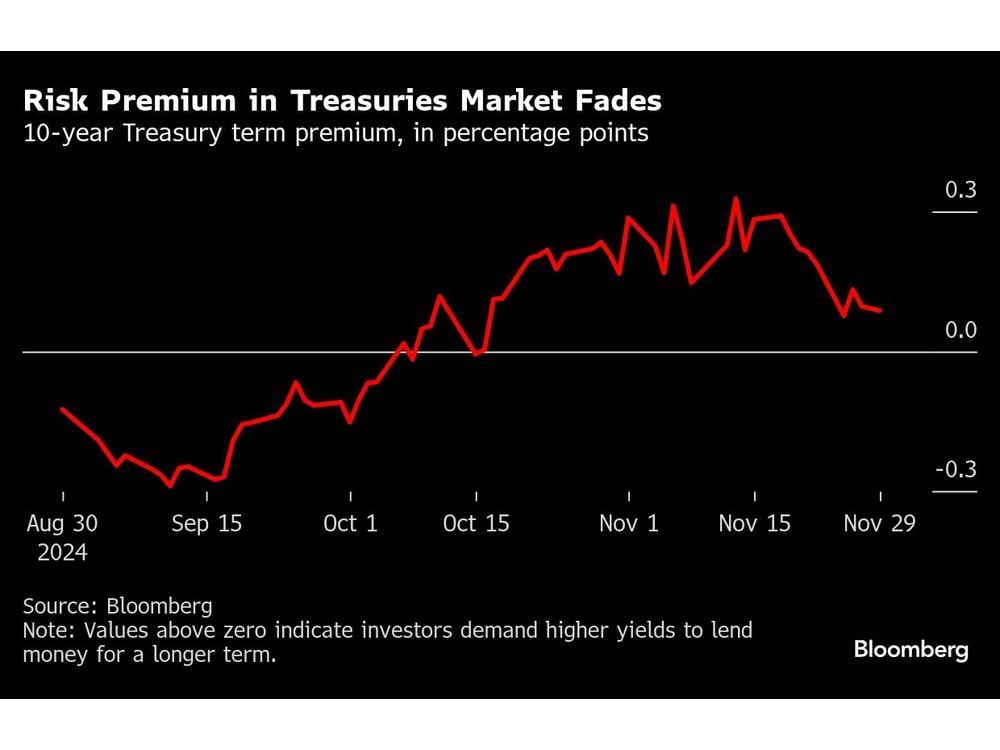

(Bloomberg Markets) — Donald Trump’s pledges to slash taxes, crack down on immigration and impose steep tariffs have long stirred concern that his policies may widen the budget deficit and fuel inflation, sparking higher interest rates and bond yields. That would be bad news for bond investors, since prices fall when yields rise. But by all measures, the $29 trillion US Treasury market has been relatively peaceful since Trump won the election on Nov. 5. The benchmark yield on 10-year bonds dropped to its preelection level, following an initial selloff. The so-called term premium—a measure of the perceived risk of holding long-term government debt—declined to a one-month low, according to a model by the New York Federal Reserve. Read More